In a global marketplace, the need for Secure Online Payment Processing Software for International Sales is paramount. This software not only ensures safe and efficient transactions but also plays a crucial role in building trust with customers worldwide. Let's delve into the key aspects of this essential tool for businesses operating on an international scale.

Introduction to Secure Online Payment Processing Software for International Sales

Secure online payment processing software is crucial for businesses engaged in international sales. It ensures that transactions are safe, reliable, and efficient, which is essential when dealing with customers from different parts of the world.

Key Features Required in Payment Processing Software for Secure International Transactions

- Encryption: Utilizing encryption technology to protect sensitive payment information during transmission.

- Multi-Currency Support: Ability to process payments in various currencies to accommodate international customers.

- Fraud Detection: Implementing tools to detect and prevent fraudulent activities in real-time.

- Compliance: Ensuring compliance with international payment regulations and standards to guarantee secure transactions.

Challenges in Processing Payments Across Different Countries and Currencies

- Exchange Rates: Dealing with fluctuating exchange rates that can impact the final amount received.

- Legal Compliance: Navigating through different regulations and requirements in various countries can be complex.

- Cultural Differences: Understanding cultural preferences and payment methods unique to each region.

Impact of Secure Payment Processing on Customer Trust and Satisfaction

Secure payment processing plays a crucial role in building trust and satisfaction among customers. When customers feel confident that their payment information is safe, they are more likely to complete transactions and return for future purchases.

Features and Functions of Secure Online Payment Processing Software

Secure online payment processing software plays a crucial role in facilitating international sales transactions by ensuring the security and efficiency of payment processing. Here are some essential features and functions that make these systems reliable and effective:

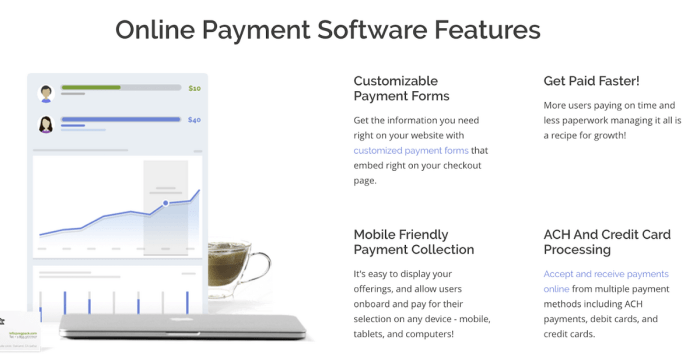

Supported Payment Methods

- Secure online payment processing software supports various payment methods, including credit/debit cards, digital wallets, bank transfers, and alternative payment options like PayPal, Alipay, and WeChat Pay.

- These systems enable customers from different countries to make payments using their preferred payment methods, enhancing convenience and flexibility in international sales transactions.

Encryption, Fraud Detection, and Compliance

- Encryption technologies like SSL/TLS ensure secure data transmission between the customer's device and the payment gateway, protecting sensitive information such as credit card details.

- Advanced fraud detection mechanisms analyze transaction patterns and detect any suspicious activities, reducing the risk of fraudulent transactions and chargebacks.

- Compliance with regulations such as PCI DSS (Payment Card Industry Data Security Standard) is essential to ensure that payment processing software meets industry security standards and protects customer data.

Multi-Currency Support and Real-Time Currency Conversion

- Multi-currency support allows businesses to accept payments in different currencies, catering to a global customer base and simplifying international sales transactions.

- Real-time currency conversion enables customers to see prices in their local currency, providing transparency and reducing confusion related to exchange rates.

- Dynamic currency conversion options also give customers the choice to pay in their home currency or the merchant's currency, enhancing flexibility and convenience in payment processing.

Choosing the Right Secure Online Payment Processing Software

When it comes to selecting the most suitable payment processing software for international sales, businesses need to consider several key factors to ensure smooth transactions and secure payments.

Comparison of Popular Payment Processing Software

- PayPal: Widely recognized and accepted globally, offering a user-friendly interface and various currency options.

- Stripe: Known for its developer-friendly tools and seamless integration capabilities with customizable features.

- Authorize.Net: Provides robust security measures and supports multiple payment methods for international transactions.

Scalability and Integration Capabilities

Businesses should look for payment processing software that can scale with their growth and seamlessly integrate with their existing systems. This ensures a smooth transition and efficient operation.

Tips for Ensuring Specific Needs are Met

- Identify the specific requirements of your international sales operations, such as currency support, multi-language capabilities, and tax calculation.

- Ensure the software complies with international payment regulations and offers secure payment processing to protect sensitive customer data.

- Consider the ease of use and customer support provided by the payment processing software to address any issues that may arise during transactions.

Implementation and Integration of Secure Payment Processing Software

Implementing secure online payment processing software for international sales involves several key steps to ensure smooth operations and secure transactions. Seamless integration with e-commerce platforms and accounting systems is crucial for efficiency and accuracy in processing payments. Let's delve into the details below.

Steps in Implementing Secure Online Payment Processing Software

- Assessment of Business Needs: Identify the specific requirements of your international sales operation and choose a payment processing software that aligns with your goals.

- Selection of Software Provider: Research and select a reputable payment processing software provider with a track record of supporting international businesses.

- Customization and Configuration: Tailor the software to meet the unique needs of your business, including currency support, language options, and security protocols.

- Testing and Integration: Conduct thorough testing to ensure the software integrates seamlessly with your e-commerce platform and accounting systems.

- Training and Support: Provide training to your team on using the payment processing software effectively and ensure ongoing support from the provider.

Importance of Seamless Integration with E-commerce Platforms and Accounting Systems

Integrating secure payment processing software with e-commerce platforms and accounting systems streamlines the payment process, reduces manual errors, and enhances the overall customer experience. Real-time synchronization of data between systems ensures accurate financial reporting and inventory management.

Examples of Successful Implementations

Companies like Amazon, Alibaba, and Shopify have successfully implemented secure payment processing software for their international sales operations. These platforms offer a variety of payment options, support multiple currencies, and provide a secure environment for transactions.

Potential Challenges and Best Practices for Integration

- Challenges: Some challenges in integrating payment processing software include compatibility issues, data security concerns, and the need for ongoing maintenance and updates.

- Best Practices: To overcome these challenges, businesses should prioritize data encryption, regular system audits, and collaboration with experienced IT professionals for seamless integration.

Conclusive Thoughts

As we wrap up our discussion on Secure Online Payment Processing Software for International Sales, it's clear that implementing the right tools can make all the difference in ensuring seamless transactions across borders. By prioritizing security and efficiency, businesses can thrive in the competitive world of international sales.

Frequently Asked Questions

What are the key features of secure payment processing software?

Secure payment processing software typically includes encryption, fraud detection tools, multi-currency support, and compliance with regulations to ensure safe transactions.

How can businesses choose the right payment processing software for international sales?

Businesses can select the most suitable software by considering factors such as scalability, integration capabilities, and the specific needs of their international sales operations.

Why is seamless integration important for payment processing software?

Seamless integration with e-commerce platforms and accounting systems ensures that transactions are processed efficiently and accurately, enhancing the overall customer experience.