Diving into the realm of Online Payment Processing Software Explained for Global Businesses, this introduction aims to provide a captivating overview of the topic, shedding light on its significance and practical applications.

As we delve deeper, we will explore the key features, security measures, integration capabilities, and compliance aspects of online payment processing software for businesses operating on a global scale.

Overview of Online Payment Processing Software

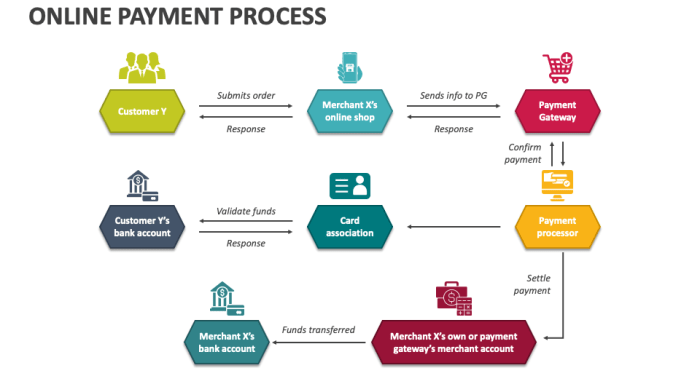

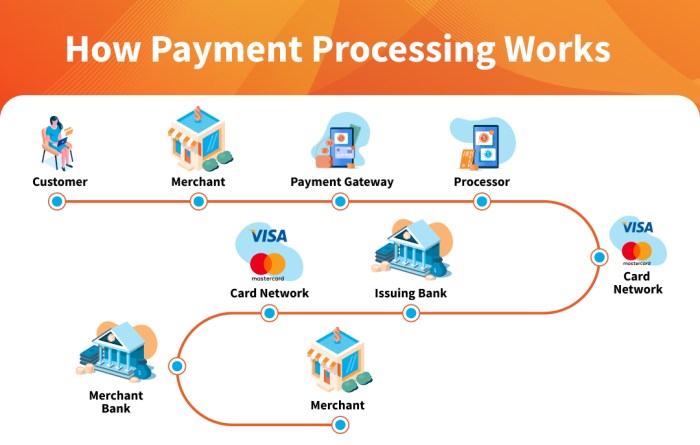

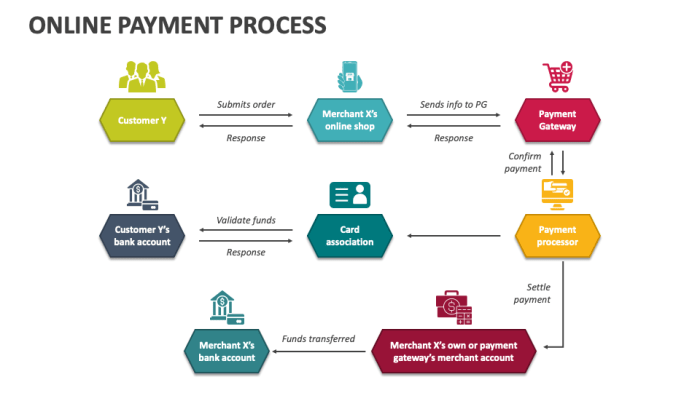

Online payment processing software refers to digital tools and platforms that enable businesses to accept payments from customers over the internet. This software securely processes transactions, verifies payment details, and transfers funds from the customer's account to the merchant's account.

Examples of Popular Online Payment Processing Software

- PayPal: One of the most widely used online payment processing platforms globally, offering a range of services for businesses of all sizes.

- Stripe: Known for its developer-friendly tools and seamless integration options, Stripe is popular among e-commerce businesses.

- Square: Ideal for small businesses, Square provides a simple and user-friendly payment processing solution.

- Adyen: A comprehensive payment platform that caters to global businesses with a focus on scalability and international transactions.

Importance of Online Payment Processing Software for Global Businesses

Online payment processing software plays a crucial role for businesses operating on a global scale by:

- Expanding Customer Reach: By accepting various payment methods and currencies, businesses can cater to customers worldwide, increasing sales opportunities.

- Ensuring Security: These software solutions offer encryption and fraud prevention measures to protect sensitive payment information and build trust with customers.

- Streamlining Operations: Automating payment processes reduces manual errors, speeds up transactions, and improves overall efficiency for businesses.

- Facilitating Growth: With the ability to scale operations and handle higher transaction volumes, businesses can expand into new markets and grow their international presence.

Features and Functionality

Online payment processing software offers a range of key features that are essential for global businesses to efficiently manage transactions. These features include:

Security

- Encryption: Ensuring that sensitive data is protected through encryption methods.

- Tokenization: Substituting sensitive data with tokens to reduce the risk of data breaches.

- PCI Compliance: Following Payment Card Industry Data Security Standard to maintain a secure environment.

Integration

- API Integration: Seamless integration with existing systems and platforms for a smooth payment process.

- Third-Party Integrations: Ability to connect with various third-party tools and services for enhanced functionality.

- Multi-Currency Support: Facilitating transactions in different currencies to cater to a global customer base.

Reporting Capabilities

- Real-time Reporting: Providing instant access to transaction data for quick decision-making.

- Customizable Reports: Generating reports tailored to specific business needs and requirements.

- Automated Reconciliation: Streamlining the reconciliation process to ensure accuracy and efficiency.

These features play a crucial role in enhancing the security, integration, and reporting capabilities of online payment processing software, ultimately benefiting global businesses in managing transactions effectively and securely.

Security Measures

In the realm of online payment processing, security is paramount to ensure the protection of sensitive financial data and to maintain the trust of customers. Implementing robust security measures is crucial for global businesses that deal with international payments.

Encryption Technologies

Encryption plays a vital role in safeguarding online transactions by converting sensitive data into a secure code that can only be deciphered by authorized parties. Some examples of encryption technologies commonly used in online payment processing software include:

- SSL (Secure Sockets Layer): A standard security technology that establishes an encrypted link between a web server and a browser, ensuring that all data passed between the two remains private and integral.

- TLS (Transport Layer Security): An updated version of SSL that offers enhanced security features and protocols to protect data during transmission over the internet.

- Tokenization: A method that replaces sensitive data with unique symbols or tokens to prevent unauthorized access to the actual information.

Importance of Robust Security Protocols

Global businesses engaging in international payments must adhere to stringent security protocols to mitigate the risks associated with cross-border transactions. Some key reasons why robust security measures are essential for global businesses include:

- Preventing data breaches and cyberattacks: Robust security protocols help safeguard sensitive financial information and prevent unauthorized access by cybercriminals.

- Building trust with customers: By demonstrating a commitment to protecting customer data, businesses can enhance trust and credibility with their clients, leading to increased customer loyalty and retention.

- Compliance with regulations: Many countries have strict regulations governing the protection of personal and financial data, and global businesses must comply with these laws to avoid legal repercussions and financial penalties.

Integration with E-commerce Platforms

Online payment processing software plays a crucial role in the smooth functioning of e-commerce platforms by providing secure and efficient payment solutions for businesses and customers. The integration of this software with various e-commerce platforms is essential for ensuring a seamless payment experience.

Compatibility with Popular E-commerce Systems

Online payment processing software is designed to be compatible with a wide range of popular e-commerce systems, such as Shopify, WooCommerce, Magento, BigCommerce, and more. These software solutions are often equipped with plugins or APIs that allow for easy integration with these platforms, making it convenient for businesses to set up and manage their online payment processes.

- Shopify: Many online payment processing software solutions offer direct integration with Shopify, allowing businesses to accept payments securely and efficiently on their Shopify stores.

- WooCommerce: For businesses using WooCommerce as their e-commerce platform, online payment processing software can be seamlessly integrated to enable smooth transactions and payment processing.

- Magento: Online payment processing software is compatible with Magento, providing businesses with the ability to accept various payment methods and streamline their online payment processes.

Advantages of Seamless Integration

Seamless integration of online payment processing software with e-commerce platforms offers several advantages for global businesses looking to enhance their online payment processes:

- Improved User Experience: Integration with e-commerce platforms ensures a smooth and hassle-free payment experience for customers, leading to increased satisfaction and repeat business.

- Enhanced Security: By integrating with e-commerce systems, online payment processing software can leverage the security features of the platform to ensure safe and secure transactions for both businesses and customers.

- Efficient Payment Processing: Seamless integration allows for quick and efficient payment processing, reducing the risk of errors or delays in transactions.

Compliance and Regulations

Global businesses operating in the online payment processing industry must adhere to a myriad of regulatory requirements to ensure compliance with international payment regulations. These regulations are put in place to protect consumers, prevent fraud, and maintain the integrity of the financial system.

Regulatory Requirements

- Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations require businesses to verify the identity of their customers and monitor transactions for suspicious activities.

- Payment Card Industry Data Security Standard (PCI DSS) compliance is essential for businesses that handle credit card information to ensure data security.

- General Data Protection Regulation (GDPR) compliance is necessary for businesses operating in the European Union to protect the personal data of their customers.

Ensuring Compliance

- Software developers implement robust compliance measures within the online payment processing software to meet the regulatory requirements.

- Regular audits and assessments are conducted to ensure ongoing compliance with international payment regulations.

- Continuous monitoring and updates are essential to adapt to changing regulations and maintain compliance.

Challenges for Global Businesses

- Complexity and diversity of regulations across different countries and regions can pose challenges for global businesses in ensuring compliance.

- Navigating the legal landscape and staying up-to-date with evolving regulations require significant resources and expertise.

- Non-compliance can result in hefty fines, legal consequences, and damage to the reputation of the business.

End of Discussion

In conclusion, Online Payment Processing Software offers a robust solution for global businesses to streamline their financial transactions securely and efficiently. By understanding its intricacies and functionalities, businesses can enhance their online payment processes and expand their global reach.

Popular Questions

How does online payment processing software benefit global businesses?

Online payment processing software helps global businesses manage transactions efficiently, enhance security, and streamline financial operations across different regions and currencies.

What are some popular examples of online payment processing software used by global businesses?

Popular online payment processing software includes PayPal, Stripe, Square, and Adyen, which are widely used by businesses worldwide for seamless transactions.

What security measures are implemented by online payment processing software?

Online payment processing software employs encryption technologies, tokenization, and secure protocols to safeguard sensitive financial data and protect against cyber threats.