Starting off with Financial Reporting Software That Simplifies Decision Making, this introductory paragraph aims to provide a compelling overview of the topic, highlighting its significance in the business world.

Exploring key features, benefits, and essential aspects of financial reporting software, this discussion will shed light on how it simplifies complex financial data for informed decision-making.

Overview of Financial Reporting Software

Financial reporting software plays a crucial role in decision-making processes for businesses by providing accurate and timely financial data analysis. This software helps businesses track their financial performance, identify trends, and make informed decisions based on real-time data.

Key Features of Financial Reporting Software

- Automated Reporting: Financial reporting software automates the process of generating financial reports, saving time and reducing errors.

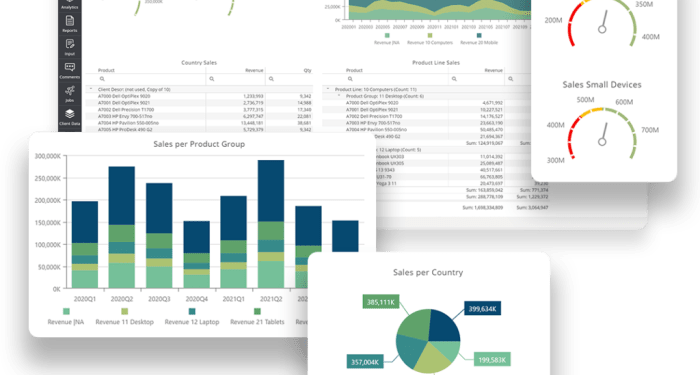

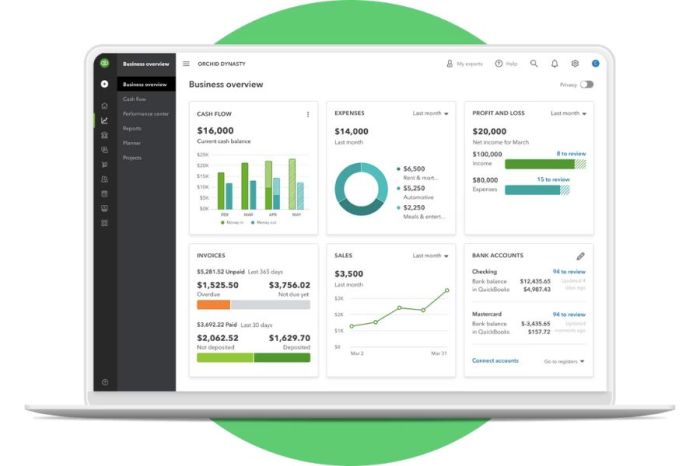

- Customizable Dashboards: Businesses can create customized dashboards to visualize key financial metrics and KPIs for quick decision-making.

- Data Integration: Financial reporting software integrates data from various sources, such as accounting software and CRM systems, to provide a comprehensive view of the company's financial health.

- Forecasting and Budgeting: These tools allow businesses to forecast future financial performance and create budgets based on historical data and trends.

Simplifying Complex Financial Data

Financial reporting software simplifies complex financial data by organizing it into easy-to-understand formats such as graphs, charts, and tables. This visual representation helps business owners and decision-makers quickly grasp the financial status of the company without delving into intricate details.

The software also allows for drill-down capabilities, enabling users to explore specific data points for more in-depth analysis.

Benefits of Using Financial Reporting Software

Financial reporting software offers numerous advantages that streamline financial data management, enhance accuracy and efficiency in reporting, and provide real-time data access for quick decision-making.

Streamlining Financial Data Management

- Automated data collection and consolidation from various sources.

- Centralized database for all financial information, eliminating the need for manual data entry.

- Customizable reports and dashboards for easy analysis and visualization of data.

Enhancing Accuracy and Efficiency in Reporting

- Reduction of human errors through automation of calculations and data entry.

- Standardized reporting templates ensure consistency in financial reports.

- Real-time updates reflect the most current financial information for accurate decision-making.

Real-time Data Access for Quick Decision-Making

- Instant access to up-to-date financial data for timely decision-making.

- Ability to generate ad-hoc reports on-demand for specific financial insights.

- Integration with other business systems for a comprehensive view of the organization's financial health.

Key Features to Look for in Financial Reporting Software

When choosing financial reporting software, it's crucial to consider key features that can simplify your decision-making process and improve the efficiency of your financial reporting tasks.

Customizable Reporting Templates

Customizable reporting templates allow you to tailor your financial reports to meet the specific needs of your business. Look for software that offers a wide range of pre-built templates that can be easily customized with your company's branding, layout, and data fields.

Scalability and Integration Capabilities

Scalability is essential to ensure that the software can grow with your business as it expands. Look for software that offers the flexibility to handle increased data volume and complexity without compromising performance. Integration capabilities are also crucial, as the software should seamlessly integrate with your existing systems and tools to streamline data flow and reporting processes.

Data Security Measures

Data security is paramount when it comes to financial reporting software. Look for software that offers robust security features such as encryption, access controls, and audit trails to protect sensitive financial data from unauthorized access or breaches. Additionally, ensure that the software complies with industry regulations and standards to safeguard your data effectively.

Implementation and Integration of Financial Reporting Software

Implementing and integrating financial reporting software is crucial for optimizing financial processes and decision-making within an organization. Here are the steps for successful implementation and integration:

Steps for Successful Implementation of Financial Reporting Software:

- Define Objectives: Clearly Artikel the goals and objectives you aim to achieve with the software implementation.

- Assess Current Processes: Evaluate existing financial reporting processes to identify areas that can be improved with the software.

- Select the Right Software: Choose a financial reporting software that aligns with your organization's needs and requirements.

- Plan Implementation: Develop a detailed implementation plan with timelines, responsibilities, and milestones.

- Training and Support: Provide adequate training to employees on how to use the software effectively to maximize its benefits.

- Testing and Monitoring: Conduct thorough testing of the software before full deployment and establish monitoring mechanisms for performance evaluation.

- Continuous Improvement: Regularly review and optimize the software usage to ensure it continues to meet your organization's evolving needs.

Integration of Reporting Software with Existing Systems:

- Ensure Compatibility: Ensure that the financial reporting software can seamlessly integrate with your existing systems such as ERP, CRM, or BI tools.

- Data Migration: Plan and execute a smooth data migration process to transfer existing financial data into the new software system.

- Customization: Customize the software settings to align with your organization's reporting requirements and data formats.

- Testing and Validation: Conduct rigorous testing to ensure that data flows accurately between the reporting software and other systems.

- Regular Maintenance: Implement regular maintenance routines to keep the integration running smoothly and address any issues promptly.

Tips for Training Employees on Using the Software Effectively:

- Provide Comprehensive Training: Offer hands-on training sessions to familiarize employees with the software interface and functionalities.

- Role-Based Training: Tailor training programs based on employees' roles and responsibilities to ensure relevance and effectiveness.

- Continuous Support: Offer ongoing support and resources for employees to troubleshoot issues and enhance their skills over time.

- Encourage Feedback: Create a feedback loop for employees to share their experiences and suggestions for improving software usage.

- Incentivize Learning: Recognize and reward employees who demonstrate proficiency in using the software to encourage adoption and skill development.

Conclusive Thoughts

Concluding our discussion on Financial Reporting Software That Simplifies Decision Making, it becomes evident that the right software can revolutionize how businesses analyze data and make critical decisions.

FAQ Explained

How does financial reporting software enhance accuracy?

Financial reporting software enhances accuracy by automating data entry, reducing human errors, and ensuring consistency in reporting.

What are some key features to look for in financial reporting software?

Essential features to consider include customizable reporting templates, scalability, integration capabilities, and robust data security measures.

How can real-time data access through software aid in decision-making?

Real-time data access enables quick insights into financial metrics, trends, and performance indicators, empowering swift and informed decision-making processes.